Malliotakis Celebrates House Passage of One Big Beautiful Bill

Legislation Builds on 2017 Tax Cuts, Delivers Border Security and Energy Independence for American Families

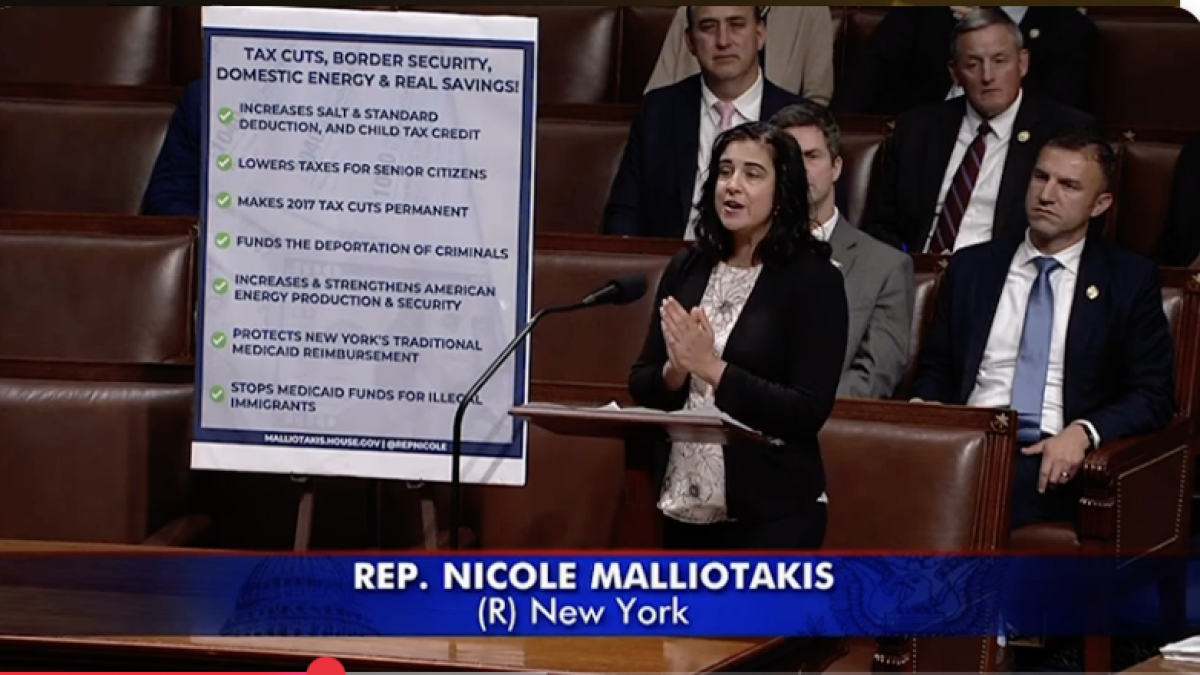

(WASHINGTON, DC) - Congresswoman Nicole Malliotakis released the following statement after the House passage of the One Big Beautiful Bill calling it "a big win for hardworking taxpayers."

“Today marks a historic victory for Staten Islanders, Brooklynites, and families across the nation who have been calling for tax relief. Our legislation builds on the success of President Trump's 2017 tax cuts by making those tax provisions permanent, while delivering additional tax relief for senior citizens, increasing the SALT and Standard Deductions, and expanding the Child Tax Credit to ensure hardworking Americans keep more of their hard-earned money.

We also included key provisions to root out waste, fraud, and abuse in the Medicaid program so tax dollars go to protect our seniors, disabled, and the most vulnerable citizens who rely on it. We also strengthen our national security, fund border barriers and the deportation of criminals, and boost domestic energy production. The Senate must now act without delay as failure to do so would let key provisions of the 2017 Tax Cuts and Jobs Act expire, leading to a $4 trillion tax hike on American families and businesses. It’s time to deliver real results and tax relief and fulfill our commitments to America.”

WATCH MALLIOTAKIS' REMARKS HERE

Highlights of the House Passed "One, Big, Beautiful Bill"

Increases SALT & Standard Deductions:

Quadruples the State and Local Tax (SALT) deduction to $40,000 and raises the Standard Deduction to $16,300 for individuals and $32,600 for married couples building on the 2017 Tax Cuts and Jobs Act, which originally doubled the standard deduction.

Tax Relief for Seniors:

Includes a provision mirroring Malliotakis' legislation to provide a bonus deduction for seniors on Social Security—$4,000 for individuals earning up to $75,000 and $8,000 for married couples earning up to $150,000.

Tax Relief for Working & Middle Class Families:

Fulfills President Trump's commitment to eliminate taxes on tips and overtime, stops the return of the Alternative Minimum Tax that crushed middle-income families, makes the 2017 tax cuts permanent, and allows Americans to fully deduct auto loan interest on American-made vehicles.

The Big Beautiful Bill also makes adoption tax credits more accessible, expands 529 education savings accounts, supports scholarships and school choice, expands the Child Tax Credit to $2,500, and improves access to child care. Malliotakis' legislation to extend tax-free employer reimbursement for students and college graduates is also included.

Protecting & Strengthening Medicaid:

Safeguards New York’s most vulnerable Medicaid population by preserving the 50% federal reimbursement match, prevents illegal immigrants from receiving Medicaid benefits, eliminates PBM's abusive use of spread pricing in Medicaid, and cracks down on fraudsters by targeting waste, fraud, and abuse.

Keeps Our Borders Secure:

Provides funding for the detention and deportation of criminal illegal immigrants, hiring of 10,000 new Immigration and Customs Enforcement personnel, enforcement of the Remain in Mexico policy and construction of new border barriers.

Revolutionizes Our National Security:

$12.5 billion to modernize our air traffic control system at Newark Airport and other facilities, funding for the Golden Dome to help protect our homeland, investments in American shipbuilding to strengthen our naval fleet, and upgrades to our military to meet 21st-century threats.

Unleashes American Energy:

Increases and strengthens domestic energy production and security. Rescinds wasteful funds from the Inflation Reduction Act saving taxpayers billions of dollars.

###